The envelope budgeting system has been around for a long time, and for good reason. It is a simple and easy way to control personal finances. However, since most people use cards and virtual payments, cash envelopes are no longer practical. Luckily, these envelope budgeting apps can help you achieve the same results without forcing you to carry dollar bills around.

FYI: if you’re just looking for some easy budgeting, check out our review of Ivy Wallet App.

1. Goodbudget

Price: Free with premium option

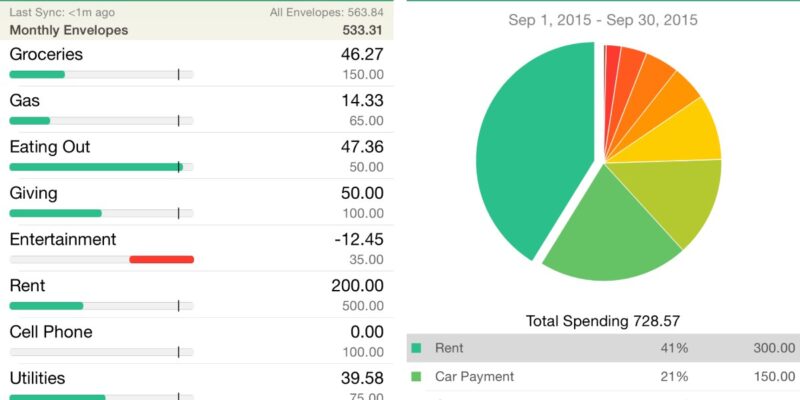

Goodbudget uses the principles of the envelope method but eliminates the physical envelopes. Instead of using cash, Goodbudget allows users to link their bank accounts to the app. They can then create digital envelopes and allocate money from their bank account into these “envelopes” to categorize their expenses. It makes it easier to track spending and keep tabs on available funds.

The Goodbudget app has default envelopes for common expenses like rent and groceries that users can move money into. In addition, users can also add custom envelopes. For example, you can set up envelopes for eating out, entertainment or saving for a vacation. In addition to being available on both iOS and Android devices, users can also use the Goodbudget website to maintain and edit their budgets. Goodbudget also allows users to sync accounts to maintain household budgets, ensuring that everyone is on the same page.

The Goodbudget app is available in both free and subscription-based versions. The free version allows users to configure up to ten envelopes while supporting only two devices. Subscribing allows users to create as many envelopes as they wish, with support for up to five devices.

2. RealBudget

Price: Free with premium option

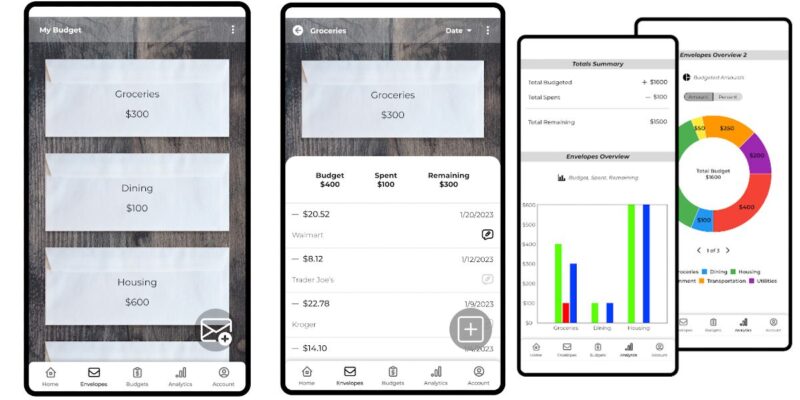

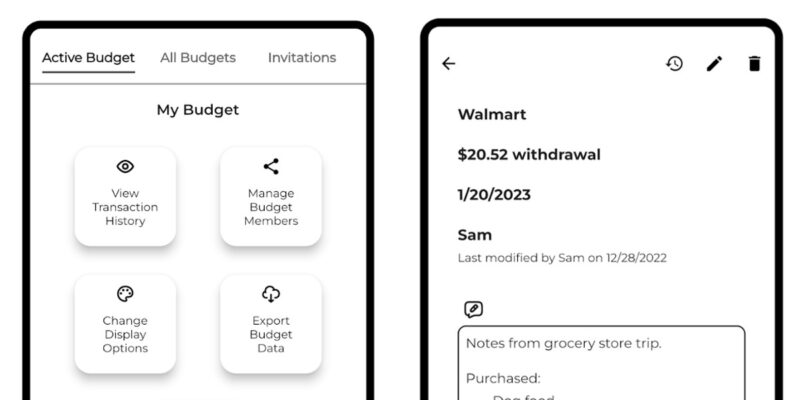

If the idea of linking a bank account to a third-party app turns you off, RealBudget is for you. RealBudget is a simple and easy-to-use envelope-budgeting app. The app allows users to create an unlimited number of envelopes for various expenses. Users can allocate certain dollar amounts to each envelope. There is no need to link your bank or any other financial accounts. Best of all, the app is completely free to use, and there are zero ads!

While the base app is entirely free to use, it is limited to a single device. This can be problematic for households that want to track spending by multiple users. RealBudget offers a premium version of the app that commands a monthly subscription fee. For a monthly fee, users can sync transactions with family members on multiple devices.

The downside to not being able to link your financial accounts is that you will have to manually log all of your expenditures. If you have a tendency to impulse buy, this can be problematic. If you forget to enter an expenditure, it will throw off the balance of your envelopes. If you are dedicated and don’t mind being more proactive, RealBudget is a simple and easy way to take control of your spending habits.

3. Pocketguard

Price: Free with premium option

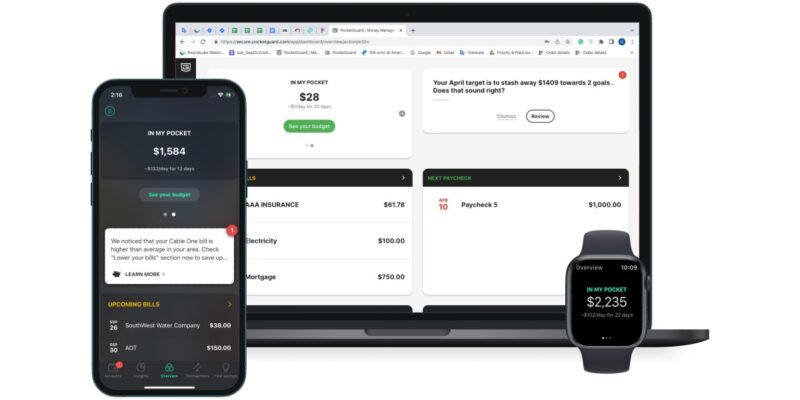

Pocketguard is another app that takes the pain out of budgeting by simplifying the process. Users connect bank accounts, credit cards and other financial instruments. Subsequently, users input their monthly expenses, such as rent and utilities. Pocketguard works its magic and allocates your available funds to your bills. In essence, Pocketguard automatically sorts available cash to “envelopes” earmarked for particular expenditures, then calculates how much money you have left over each month for discretionary spending.

Pocketguard can also be used to give users a snapshot of their overall financial health, tracking their net worth. The paid version of the app offers a debt repayment tool, as well as the ability to export your transactions to a spreadsheet.

Pocketguard is a good option for folks who want a “hands off” approach to budgeting. It tracks your expenses and figures out how much users can comfortably spend without going beyond their means. However, it’s not the best tool for more proactive financial planning.

Tip: want help tracking your finances? Try these cross-platform finance tracking apps.

4. YNAB

Price: $14.99/month or $99/year

You Need a Budget, or YNAB, is an app that works on the “zero-based budgeting” method. This isn’t exactly an envelope budget; however, it works on the same principle of allocating your money to different categories. The basic principle of “zero-based” budgeting is that every dollar you have coming in is accounted for and earmarked for a particular expense, until you literally have zero dollars left to spend.

YNAB allows users to dictate how much of their income should be allocated to various categories, such as expenses and savings. In assigning every single dollar you earn, the idea is that users will become more proactive with their money. Unfortunately, this means that users need to be, pardon the pun, invested in their long-term financial health, as the app requires users to be more hands-on than others. That said, YNAB is more of a spending planner, rather than a spending tracker.

Thankfully, the YNAB website hosts a number of support videos and articles. These can help users develop habits that will ensure they are getting the most out of YNAB’s money management tools. Considering YNAB charges a fairly hefty sum, users should think twice if they want to invest the time and effort. If not, YNAB is just another way to throw money down the drain.

Conclusion

The apps listed above utilize a tried and tested method of money management, albeit refined for the modern era. However, if the idea of downloading an app or syncing your financial accounts to a third party isn’t for you, there are other methods of taking control of your finances. You can use Microsoft Excel to set up a zero-budgeting system, or use a budgeting template in Google Sheets.

Image credit: Pexels

Our latest tutorials delivered straight to your inbox